What is the proposed by-law?

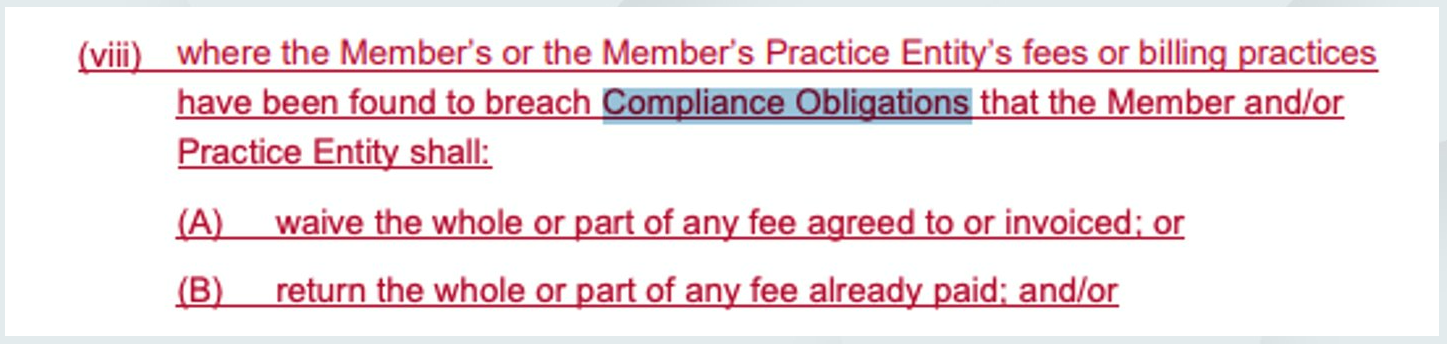

The proposed by-law would allow the CA ANZ’s Professional Conduct Committee to demand that you cancel an invoice or refund fees to a client if they rule you have breached your ethical standards.

Why does this matter if I’m not a CA ANZ member?

It’s not unreasonable to expect that if this by-law is voted in by the CA ANZ members, CPA and IPA may look to introduce similar by-laws.

What would be the CA ANZ’s process to handle a complaint?

When the client makes a complaint against you, it will be reviewed by the Professional Conduct Committee (PCC). If they consider it a valid complaint, they will investigate it and decide if there is a complaint to answer. The PCC can recommend training and even cautioning a member. However, if severe, the PCC will refer the complaint to the Disciplinary Tribunal. If they deem there is an ethical breach, they may require you to refund fees.

Why are they looking to introduce this by-law?

This is very similar to a current by-law in New Zealand, and CA ANZ is looking to align the laws in New Zealand and Australia.

* ‘Compliance Obligations’ is the difference between the Australian and New Zealand by-laws

Why should we be concerned if this hasn't been used much in New Zealand?

First and foremost, it’s a chance to examine it and discuss it before it’s voted on.

Currently, this has been applied to more than 10% of cases. However, information from the Chartered Accountants Annual Report indicates that client complaints increased in FY23. We expect that will continue because we are operating in a much more challenging compliance environment, the regulatory environment is more complex, the same thing you did last year may not apply this year, and communicating changes to clients is getting harder and harder.

Also, clients can get upset about things that are outside of your control. For example, a client who's upset that their tax refund this year is lower than what they're expecting because their property went into positively gearing instead of negatively geared, and they missed out on the low- and middle-income earners tax offset, which wasn't available to them. None of that is your fault. However, there are clients, especially for small- and medium-sized firms, that will badmouth you in public forums for this.

What happens when clients find out that there's a chance they can get their money back? Once word gets around, complaints will surely increase.

Why should we be concerned if they do not get involved with a fee dispute unless there is an ethical breach?

Most fee disputes have some angle that could be construed as an ethical breach.

What should we do?

If you’re a member, you should vote how you see fit. You're not going to get what you want if you're not active when you do get the opportunity to have a say.

CA ANZ is including in the process that they will be more transparent with the outcomes of fee disputes, so we should all be watching very closely, and if we start to see a run on fee refunds, then we should be asking some very real questions.

I’m a CA ANZ Member, how can I vote?

If you no longer have the email sent to you with the voting link, you can email governance@charteredaccountantsanz.com and request a new voting link.

How can I protect my business?

Tighten up the way your practice is run with regards to your client engagements to limit the chances of a client getting put offside.

Recent

Resources

Trust Distribution Hub

Your Trust Distribution process should start by reviewing the deed to determine whether an update...

Tax Planning Hub

A strong Tax Planning strategy allows you to take your clients beyond just tax reduction...

Accountant’s Foundation: Professional Firm Profit (PFP)

PCG 2021/4 is a practical compliance guideline regarding the allocation of profits from professional firms,...