Managing your client relationships in the right way means you’ll have the energy to give your clients your best attention, build your practice to what you’ve envisioned and realise an enjoyable work/life balance. For accountants, billing at the right level allows you to earn more and service your clients better.

But in the real world, it’s far too easy to justify not billing appropriately. You might not want to bill because you don’t think they can afford it, or someone else is charging a much lower price than you think is fair. Or perhaps you think it doesn’t take that long for you to do - completely disregarding the years of experience it’s taken you to get to that point. There are hundreds of reasons to choose from.

Better accounting billing starts with your mindset, so to help you get past these barriers, we’ve put together this accounting billing guide.

1. Define the value you bring to your clients

You’ll never build what you’re truly worth if you don’t believe in your value, and there’s no way you can get the clients who can pay what you want to charge if you don’t let the community know your fees.

To define your value, identify which of the following you provide to your clients. It could be one or a combination.

- Increase in profits

- Reduction in tax

- Increase in wealth

- Personal time back

- Peace of mind

For example, completing a client’s tax returns is not “just a tax return” - you’re providing a reduction in tax and peace of mind that it’s been done correctly.

2. Ensure you’re connected with the client

To be connected, a client must:

- Trust you,

- Believe you can do the job the way they need it done,

- Understand the value you will create for them.

Connecting with your clients should not solely be part of your pricing process – it should be an ongoing part of your relationship.

It’s important to regularly check in with clients to make sure you’re doing enough, especially for clients you’ve had for between three and five years. It can be more important with these clients because you may have not yet been through a major life event like a birth, death, or marriage that solidifies the connection. If you want to reach one of those events, you need to work on your connection.

3. Determine the approach needed

You will need one approach for pricing a new client and a different approach for re-pricing an existing client.

Accounting Billing Guide for New Clients

When starting out with a new client, make sure you use a profitable fee scale that will scale well with your practice.

Capture revenue for the advice that you may previously have been providing for free by including an “unlimited Tax Advice” service in your overall bundle.

Be transparent in all of your pricing! It helps build trust and establish your connection.

Accounting Billing Guide for Existing Clients

Clients shouldn’t join you and pay the one price forever. Your costs, like wages and rent, are increasing, so your billing should, at the very least, include a CPI increase. Be sure to consider other increases for each job, like a change of scope or complexity. If you’d like more information about re-pricing, see this blog.

4. Decide on a fee scale

Work out a fee scale that is profitable and scalable for your business.

Charge fees according to:

- The number of

- Monthly transactions,

- Bank accounts,

- Monthly invoices issued, and

- Employees.

- The quality of the bookkeeping, and

- The complexity of the job.

When deciding on the fee scale, consider the frequency of:

- Payroll,

- Reporting, and

- Bank reconciliations.

![]() A fee schedule is available for customers of ChangeGPS.

A fee schedule is available for customers of ChangeGPS.

5. Detail all entities and actions

Be fully transparent about what is included in the quote. Provide a detailed list that includes all entities and actions with the fees.

Being fully transparent helps to prevent scope creep, as you and the client can easily identify what is covered in the quote.

6. Explain the value

Now that you completely understand the value you bring, it’s time to communicate this to your client. A foolproof way of doing this is with the Value, Plan, Price or VPP method.

The VPP method provides the information to the client in the following order:

Value - share with them the values you provide that you discovered in step one.

Plan - tell them the plan for getting this value and the work you’ll need to do to accomplish it.

Price - then share with them the price.

Next steps – finish your message with the steps they need to take to get this happening.

For example, when a customer comes to you to tell you they’ve sold a block of land and made $200,000 profit. They would like your help on saving tax.

Value – With what you’ve explained, I believe I can save you $25,000 in tax with the peace of mind, knowing it will be lodged properly with this capital gain considered.

Plan – To do this, I’m going to need some more information from you. I’ll have to calculate the gain and then give you advice on what you can do and the time periods in which you’ll need to do these things to be able to save tax.

Price – Advice will be $1,000 + GST.

Next Steps – please let us know if you’re happy for us to proceed, and we’ll get moving.

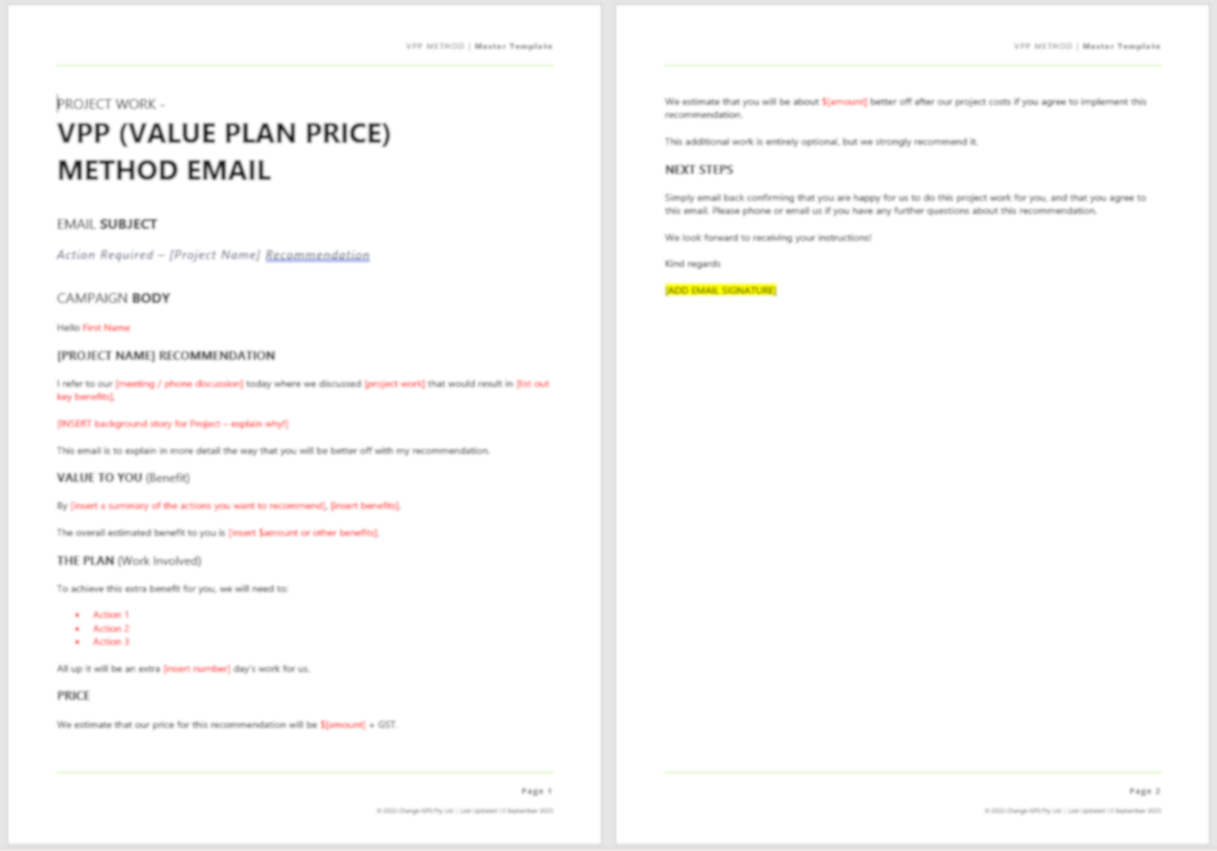

![]() ChangeGPS contains 38 templates to help you explain the value through the VPP method, including a master email that can be used for any project.

ChangeGPS contains 38 templates to help you explain the value through the VPP method, including a master email that can be used for any project.

And now the hard part is done. You’ve clearly identified the value you bring to the client and have a better accounting billing guide that will help you build a better practice and provide a high level of support to your clients.

There are just a couple of things to keep in mind after the quote has been accepted.

7. Watch out for scope creep

Be aware of changing requirements that will result in more work, and make sure that your team are trained to identify it too, because if you don’t detect it early, it will spread.

Some great ways to inspire your team to deal with scope creep are to roll play possible scenarios to help them prepare for these conversations with clients and to have weekly success story meetings to build their confidence.

Set yourself up from the beginning to avoid scope creep by issuing a clear engagement letter detailing everything, including all entities and actions with the fees. Also, it’s key to include a clause in your engagement letter that lets clients know that when preparing their financial statements, something may be discovered that requires more work and an additional work order will be sent to cover it.

If scope creep does arise, discuss it immediately with your client. Don’t leave it until the end of the job, and if extra work is required, issue a price variation.

Like all change management, it’s important to recognise the behaviour that you want and to call out the behaviour you do not.

Use every opportunity to remind your clients of the value you create for them. Remember you are building a connection built on trust, their belief in you, and the value you create for them.

Like to hear more about the better accounting billing guide? Watch this on-demand webinar with ChangeGPS CEO David Boyar and Founder Timothy Munro.

Better Billing Bootcamp

Watch Now

Recent

Resources

Trust Distribution Hub

Your Trust Distribution process should start by reviewing the deed to determine whether an update...

Tax Planning Hub

A strong Tax Planning strategy allows you to take your clients beyond just tax reduction...

Accountant’s Foundation: Professional Firm Profit (PFP)

PCG 2021/4 is a practical compliance guideline regarding the allocation of profits from professional firms,...