How to stay up to date this tax planning season?

Do you feel ready to navigate the complexities of this year’s tax planning season to keep your clients informed and protected?

Amidst such a busy time, how do you keep clients informed about their tax position and audit risk profile? The ATO has made it clear that your advice needs to be documented and contemporaneous – how will you record this?

One of the simplest and most practical ways to reduce client risk is through early tax planning. By sitting down with your clients in March and mapping out their tax planning scenarios, you’ll not only be able to better support your clients, reduce their tax and protect their assets, but you’ll be increasing your firm profits as well.

At ChangeGPS we give accountants the tools and resources to deliver elegant, efficient and de-risked advice, through TaxPlan Advanced.

How is TaxPlan Advanced different to

Taxplan Pro?

Based on TaxPlan Pro, TaxPlan Advanced offers additional reports to communicate complex ATO Professional Compliance Guidance updates including:

Professional Firm Profit Tax Advice Report

Produce Tax Advice for Professional Firm clients (ie. doctors, accountants, lawyers) to establish the tax payable vs audit risk profile the client is comfortable with in light of the ATO's PCG 2021/4.

S100A Trust Distribution Advice Report

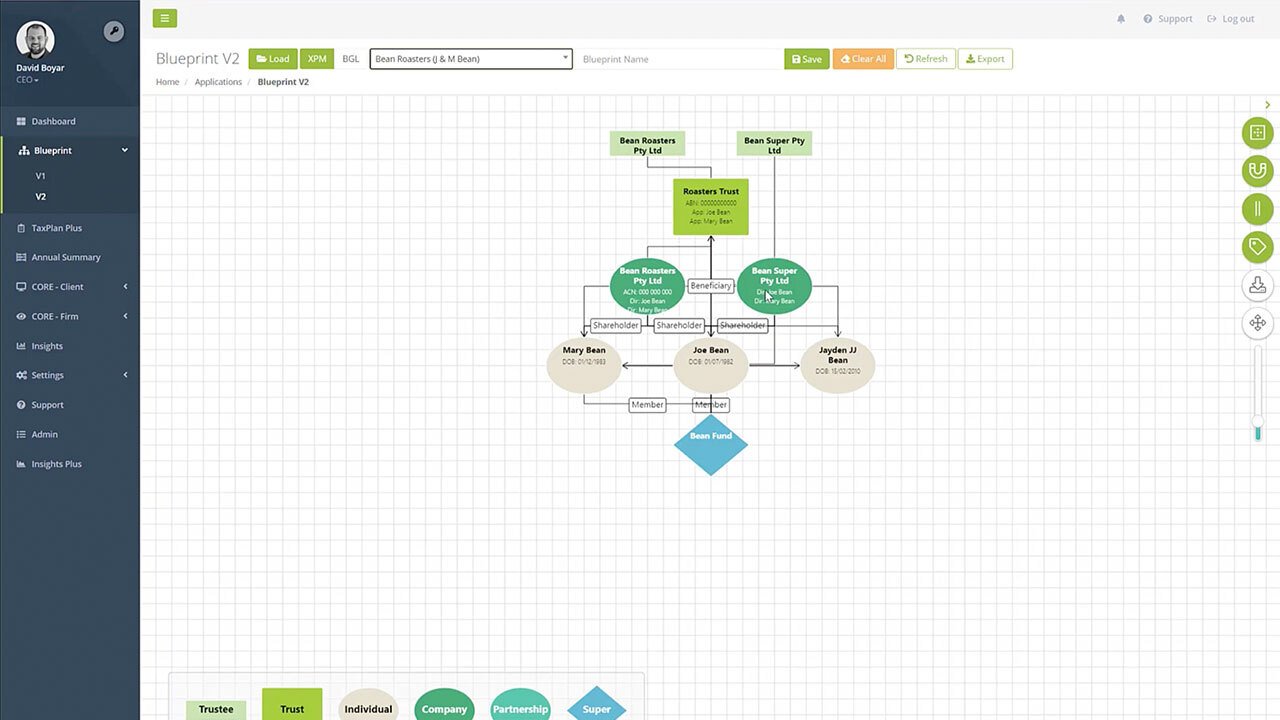

Produce an advice report to outline the impact of the s100A guidelines which changes the way profits from a Discretionary Trust (also known as a Family Trust) can be allocated. For clients with a discretionary Trust, you need to provide this advice report to inform them of the new TR tax ruling – which will impact how they distribute to their trustees.

Educate your Clients

Clients don’t always know what tax planning is and how it benefits them. Use our VPP emails to clearly demonstrate the Value, Plan and Price and stop ‘Quick Tax Chats’ before they begin.

Stay Compliant

De-risk your practice and help your clients make educated decisions about their level of risk when it comes to tax planning.

Increase Service Delivery

Expand your service offering with ChangeGPS. Educate clients on tax planning adjacent services like Asset Protection.

Key Features and Benefits

TaxPlan |

Pro |

Advanced |

|

Full Client Report which comprises:

|

||

|

Excel Snapshot |

||

|

TaxFlow Report to project tax payable over 18 months |

||

|

Scenario Comparison Report |

||

|

Professional Firm Profit Tax Advice |

||

|

S100A Trust Distribution Options Tax Advice |

||

|

Div7a Report |

||

|

Tax Planning Scenarios & Calculation |

||

|

TaxPlan System & Client Emails

|

||

|

Client Offer Export |

Register for our next Taxplan Advanced Product Webinar and see the magic in action.

How to Get the Most Out of Tax Planning Season

Join our upcoming four-part webinar series on all things tax planning. Hosted by Tim and Dave this series will deep dive into:

- How to setup your 2023 Action Plan

- How to market your services effectively

- How to deliver elegant advice reports in minutes and handle those tricky client conversations

- How to stay up to date with advance tax planning strategies

Hear From the ATO How These Latest Professional Compliance Guidelines Impact your Firm

In the last twelve months, we’ve hosted multiple sessions with ATO Representatives. These sessions aimed to educate accountants on the implications of recent changes for their firms, and how they can effectively communicate the resulting tax payable increase to their clients without incurring blame.

Replay the session below:

Or see the TaxPlan Advanced difference in action

Watch on-demand our most recent webinar event, Navigating the Delicate Balance Between Lower Audit Risk and Increased Tax Payable.