For accountants to automate, standardise and de-risk—while using hundreds of resources to demonstrate and bill real value.

ChangeGPS makes our practice more efficient by allowing us to leverage partner time. It standardises the way of working for our Accountants and means I don’t have to do the technical things. It allows us to pack more value for our clients for very little extra time.

Oliver Hunt

Partner, McSwan & Hunt

TaxPlan Pro is so profitable for us that I would pay $990 per month for it alone.

Mark Fisher

Partner, Balance Accounting

We knew what we wanted-ChangeGPS gave us the direction and clarity to implement.

Reuben Bergola

Partner, New Wave Business Solutions

For profitable,

consistent

advice.

Get Pricing

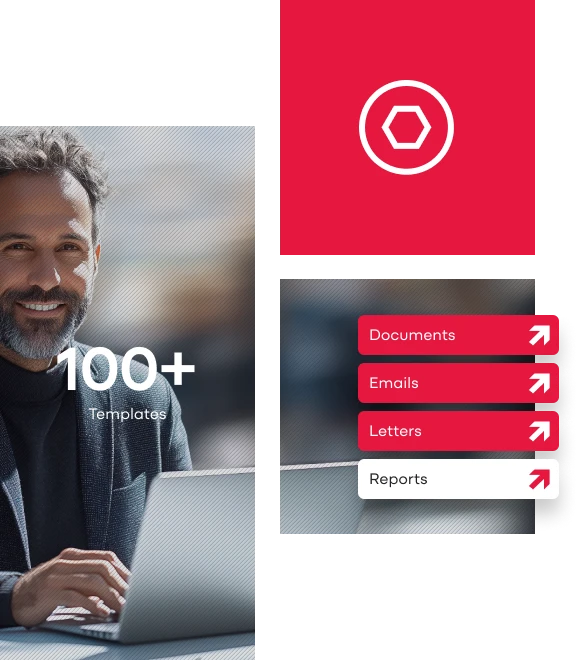

Your complete system to evolve your practice with hundreds of documents, emails, letters and reports to standardise and scale client service.

Straight to

everyday

AI power.

Get Pricing

Access Evo is the new AI enabled software experience that transforms your everyday workflows with powerful intelligence, automation, and insights – so you get more done with less effort.

Product Demo

Book a 15-minute product demonstration with one of our New Member Consultants to focus on your practice needs.

We’ll help figure out the pathways of products and people toward your more profitable future practice.

Explore

We knew what we wanted-ChangeGPS gave us the direction and clarity to implement.

Reuben Bergola

Partner, New Wave Business Solutions

After spending over 20 years in the chartered firm environment, including experience with the Big 4 firms, I decided to become a sole practitioner in 2024. The ChangeGPS platform has…

Julia King

Sole Practitioner, Affirmative Business Advisory

TaxPlan Pro is so profitable for us that I would pay $990 per month for it alone.

Mark Fisher

Partner, Balance Accounting

Recent

Resources

Trust Distribution Hub

Your Trust Distribution process should start by reviewing the deed to determine whether an update is required, considering the relatively new changes.

Tax Planning Hub

A strong Tax Planning strategy allows you to take your clients beyond just tax reduction and provide them with all the benefits of Tax Planning.

Accountant’s Foundation: Professional Firm Profit (PFP)

PCG 2021/4 is a practical compliance guideline regarding the allocation of profits from professional firms, released by the ATO and in effect from 1st July 2022.

Unsure which

product you need?

Our Product Finder can help you narrow down the options.